How will the Coronavirus impact the Housing Market? Update March 16, 2020

Windermere Chief Economist Matthew Gardner has been following the situation closely, watch this video for his thoughts on how COVID-19 will impact the national housing market and economy.

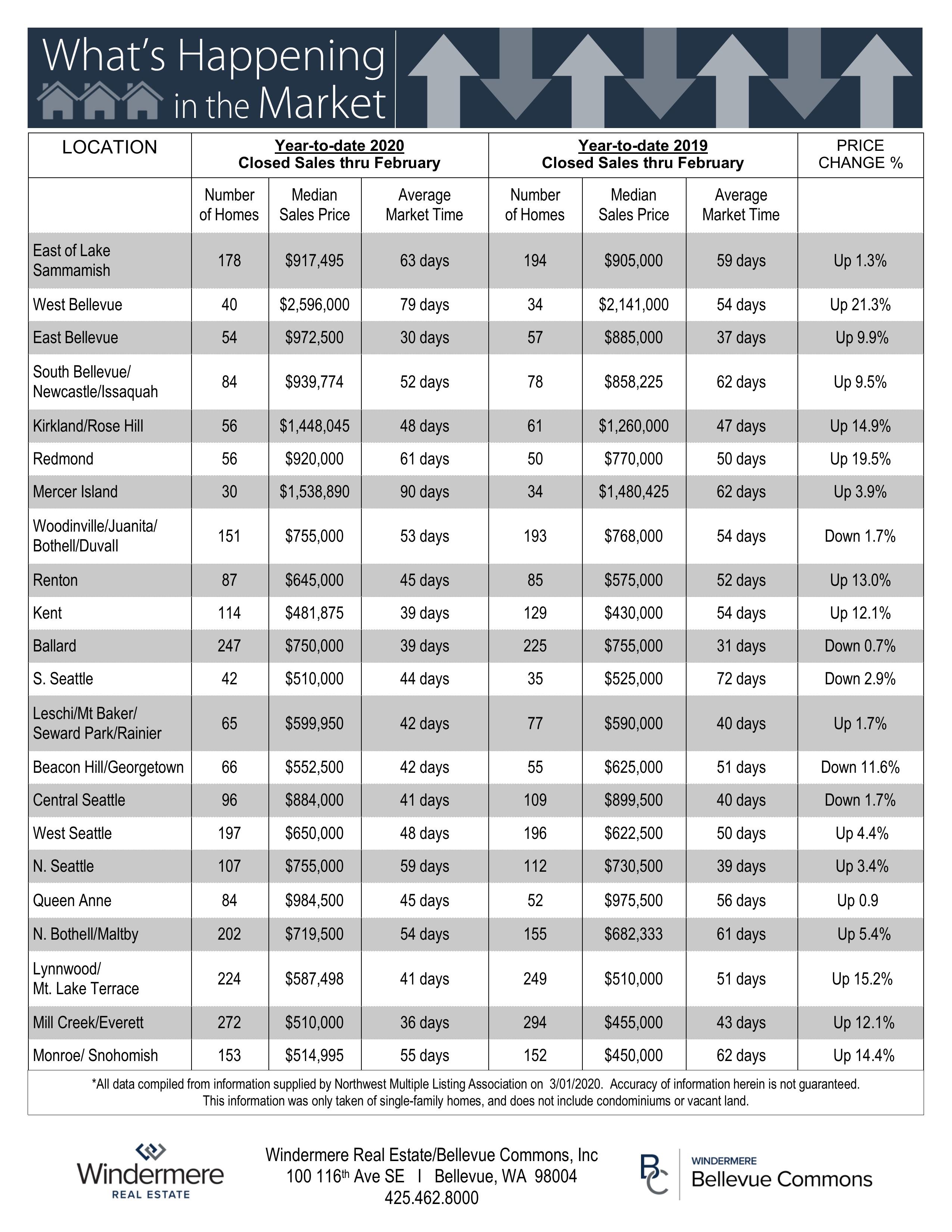

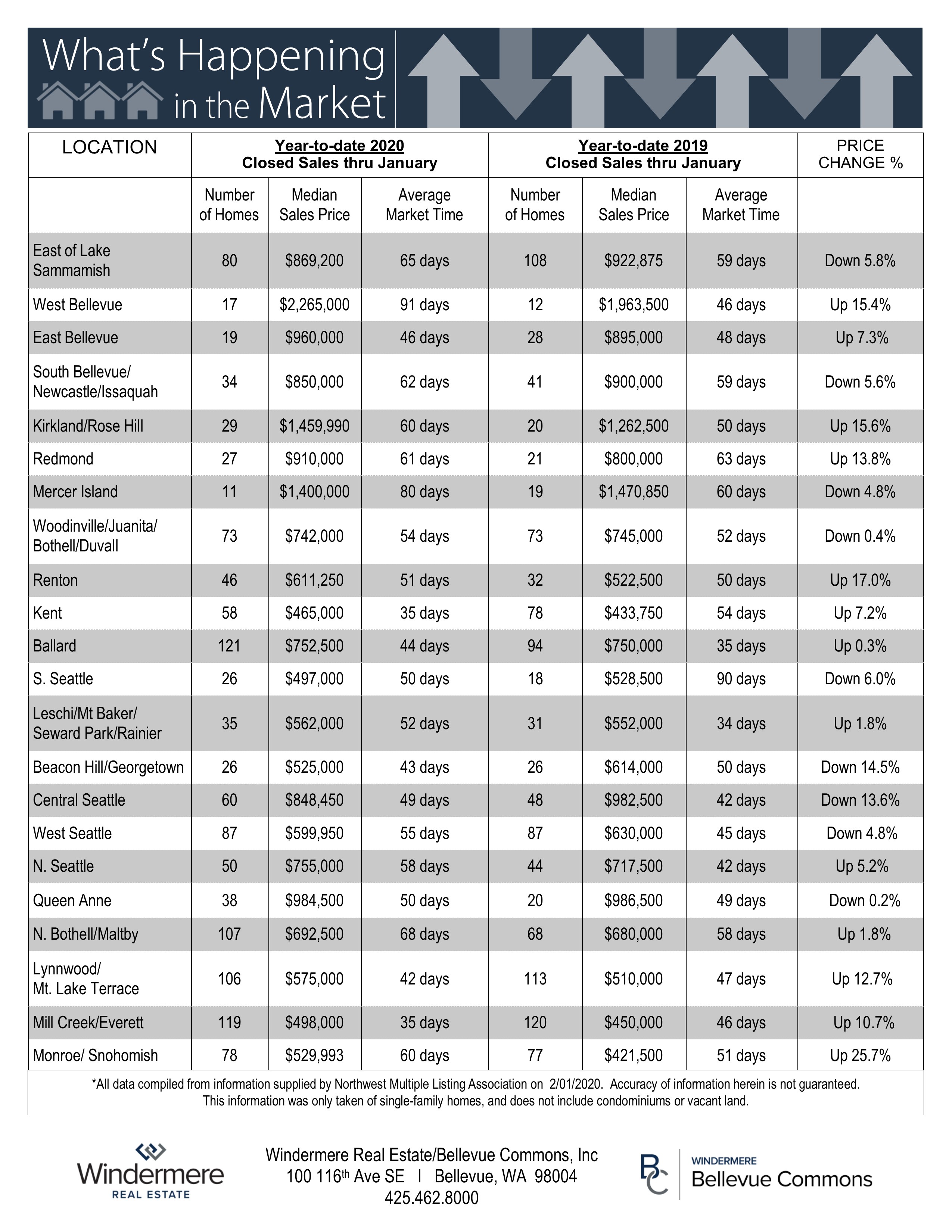

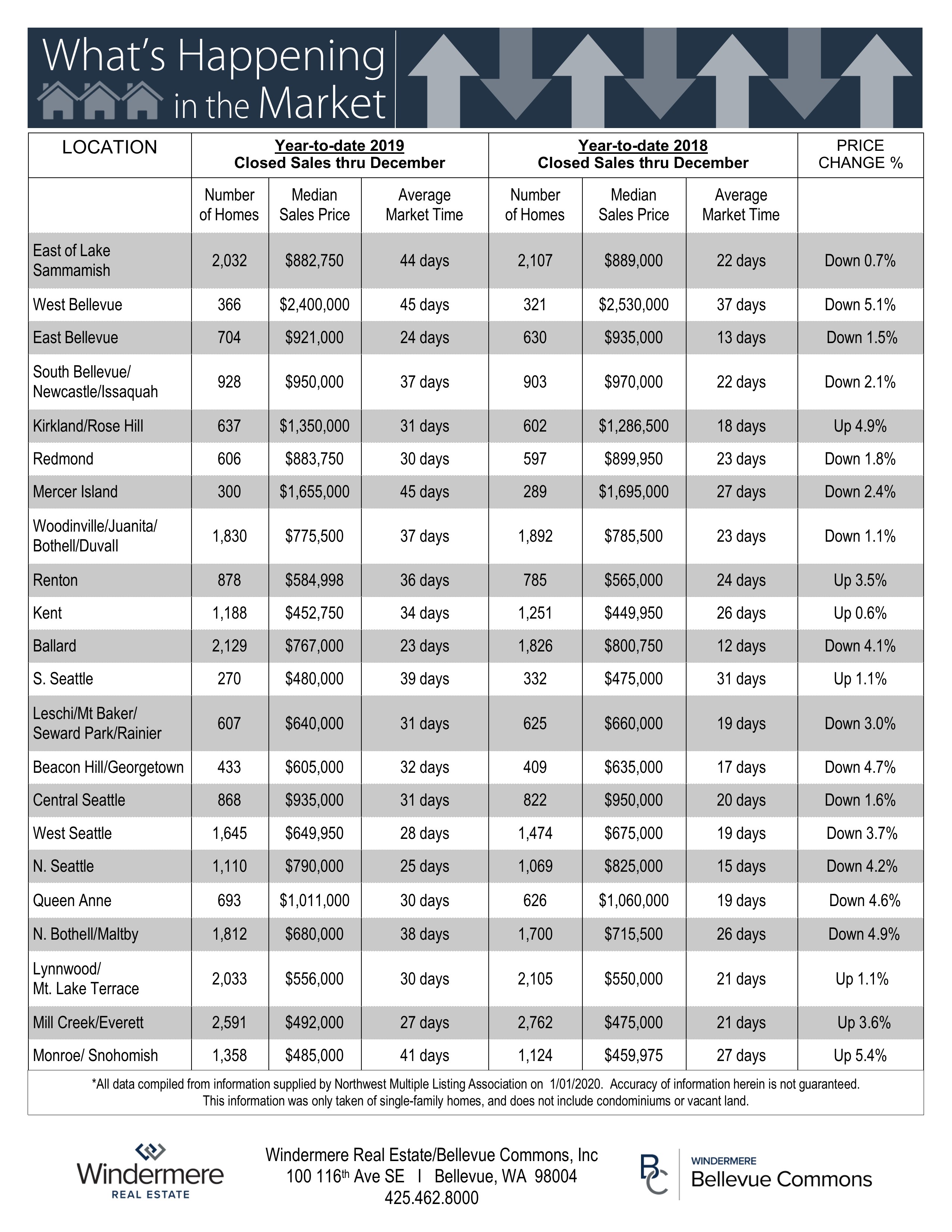

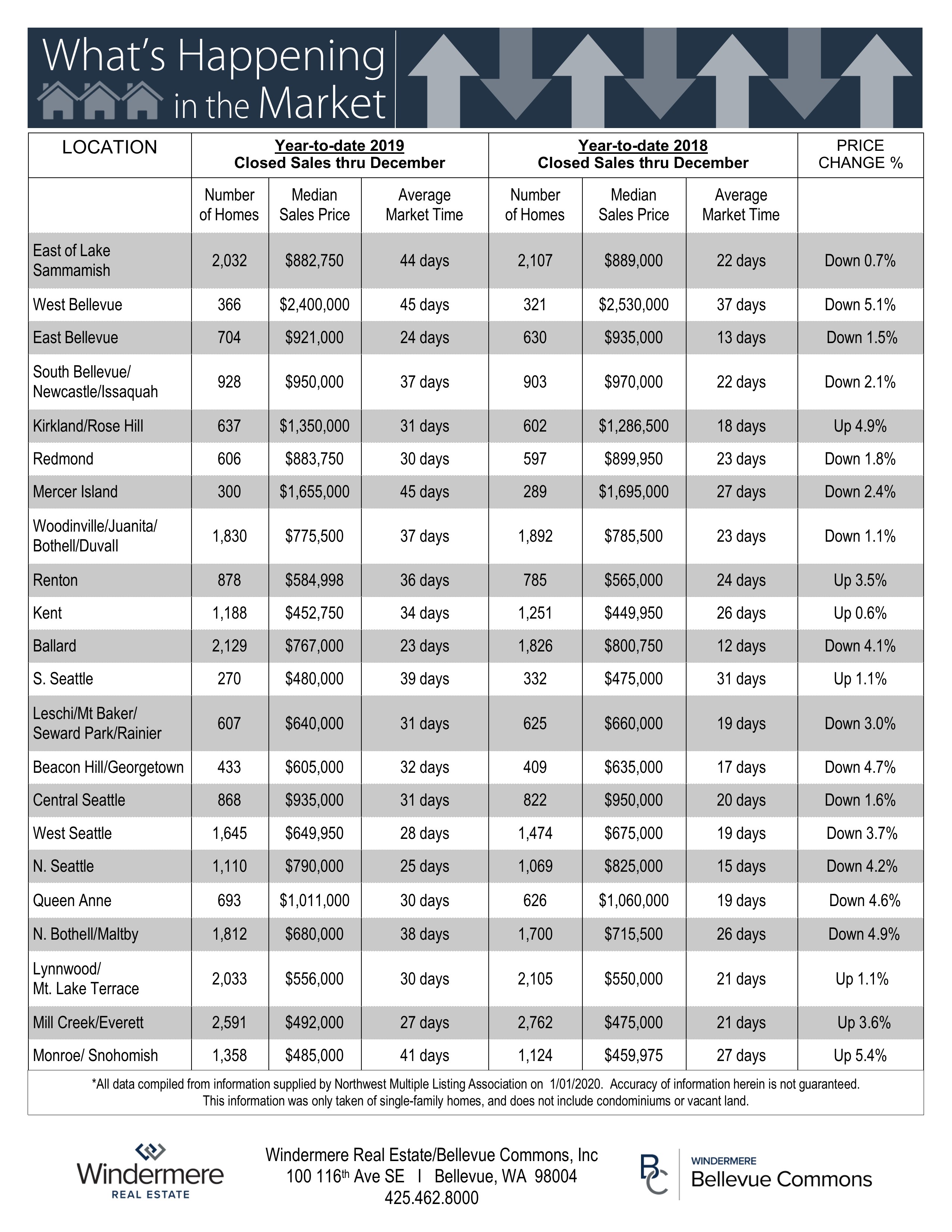

What’s Happening in the Market?

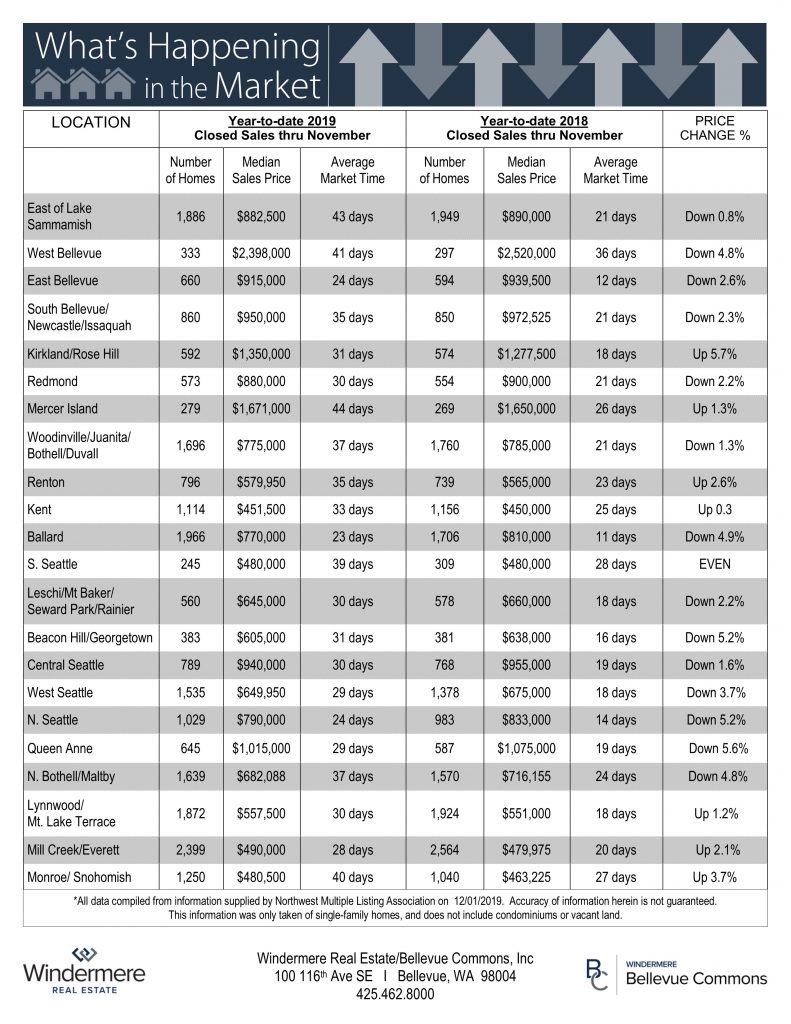

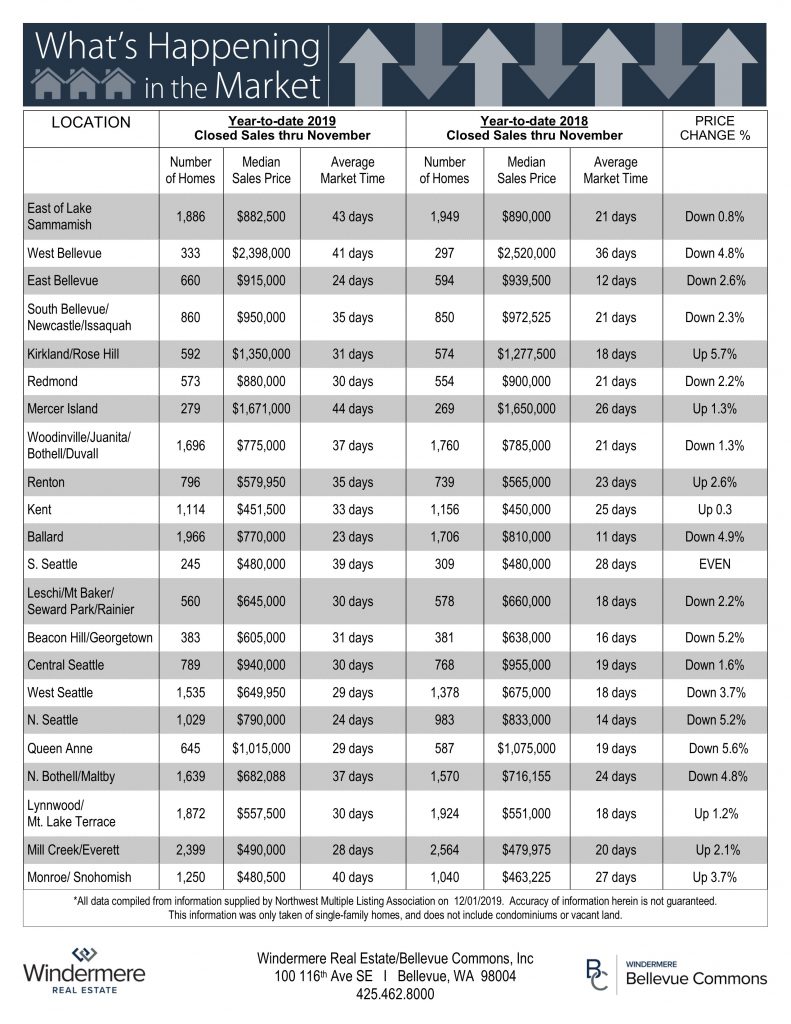

Buying/Borrowing Power is now up 12% due to extremely low interest rates (Roughly 3.70%) compared to this time last year while prices are continuing to climb and have reached 2018 prices in most areas. November pendings were up 20% over last November effectively reducing available properties towards all-time lows where we are currently standing at 1.2 months of inventory. There doesn’t seem to be any relief in the near future with a flood of new tech jobs entering the marketplace, but Buyers are still being very selective about purchasing properties that are in turn key condition.

First posted at windermere-bellevue.com

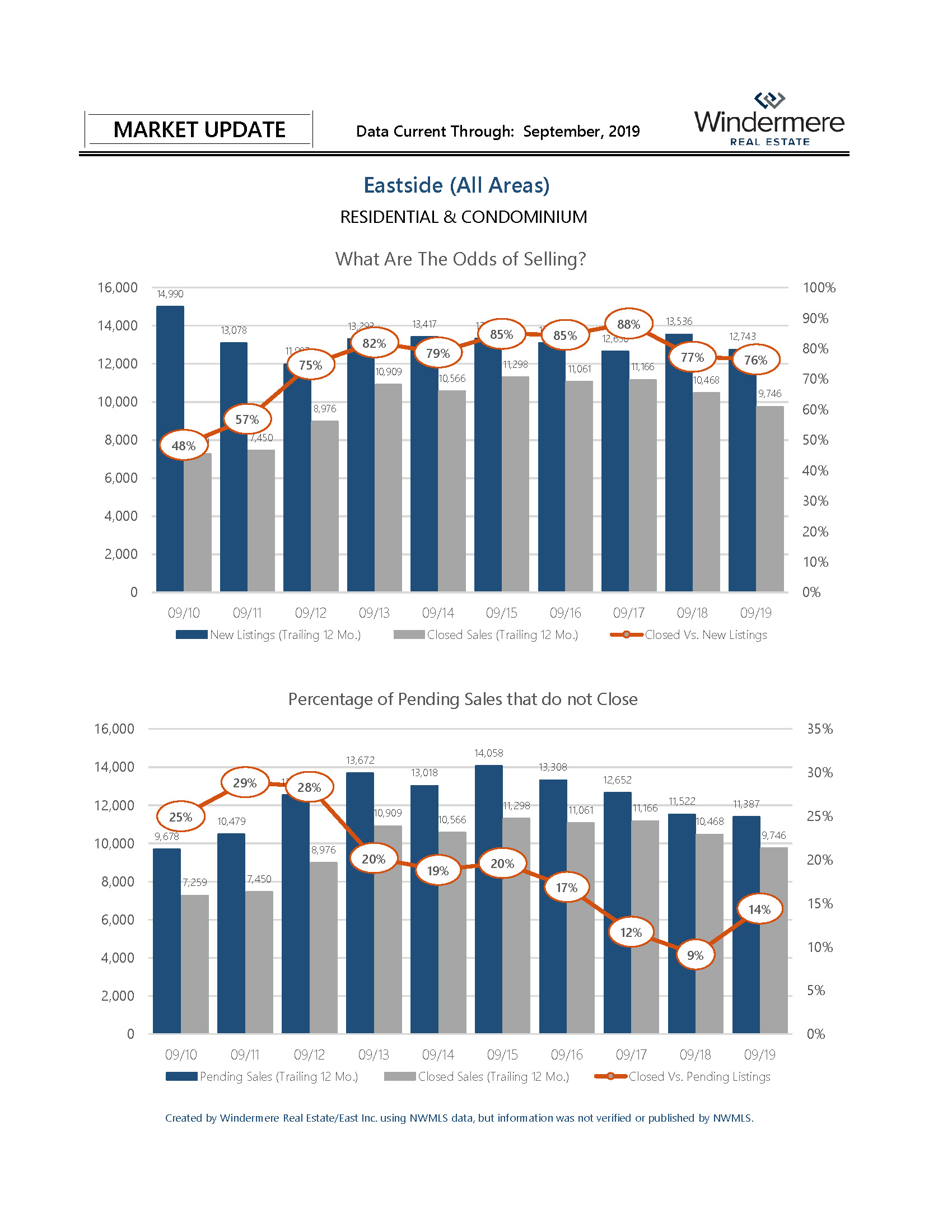

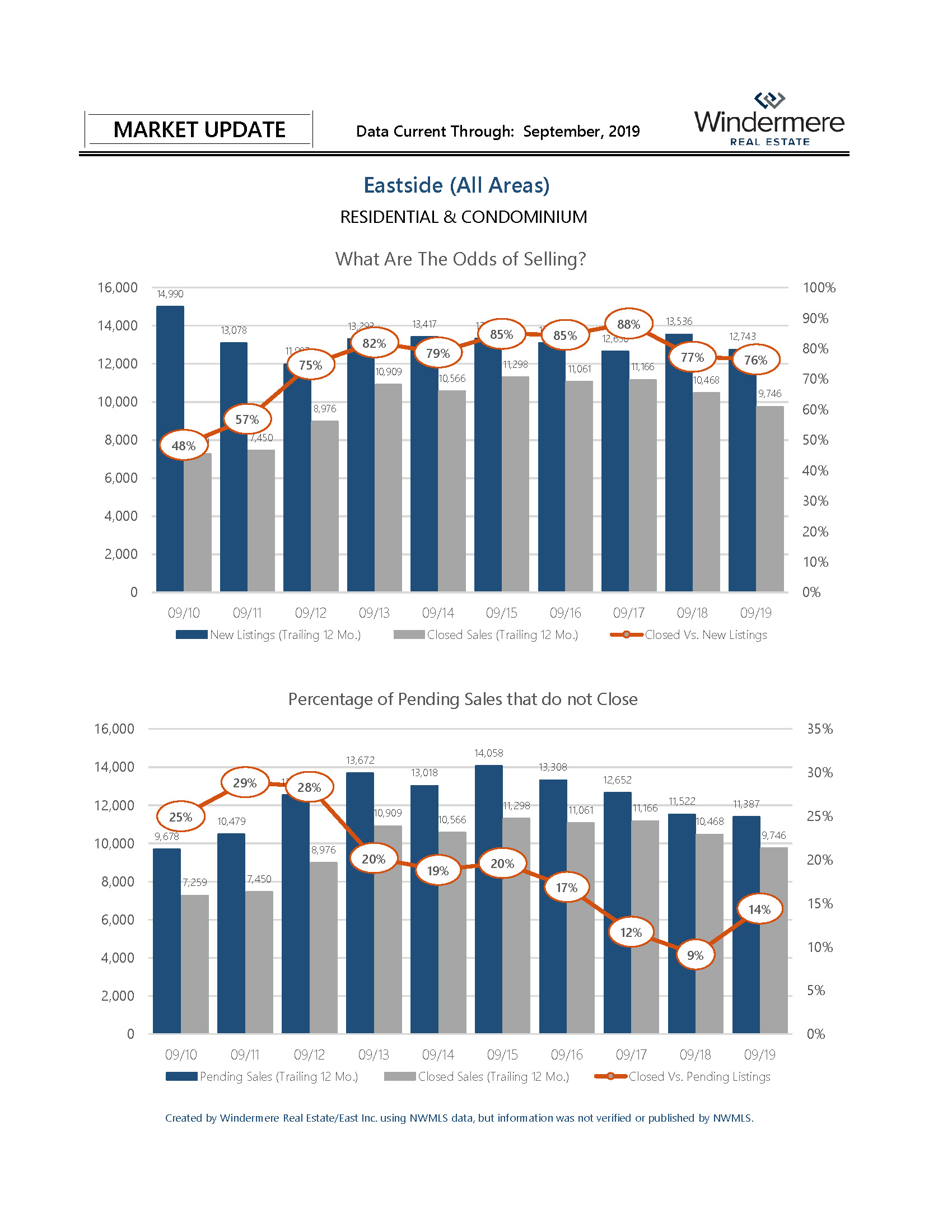

September 2019 Windermere Statistics: EASTSIDE (based on Residential and Condominium report):

• Sales are good (pending sales up 9% for September vs last year 931 vs 857). Inventory is down 21% from a year ago (1,713 vs 2,161).

• Sales up and inventory down is good for sellers, but it does not feel too good. Prices are flat. Only 18% of September closings were for over list price compared to 60% in the hot hot markets (spring of 2017 & 2018). Finally, about half (46.8%) of properties that sold, sold with less than 15 days of Days on Market. List price must be close to value to sell.

• Interest Rates, Interest Rates, Interest Rates… 3.61% vs 4.63% from a year ago (page 5).

A one percent change in interest rate is a 10% change in purchase price.

• Competing for a listing? (share from page 2)

1. What are the odds of selling 3 in 4 (75% for trailing 12 months), 1 in 4 are not selling.

2. Percentage of Pending Sales that don’t close is 1 in 8 (14% for trailing 12 months)

Who you hire matters!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link