Clients Appreciation and Christmas Party 2022- Highlights Video. Merry Christmas!

In this video, we’re celebrating Oleg Doukhnevitch’s amazing achievements in the real estate market!

From buying and selling properties to becoming a real estate ninja, Oleg has done it all!

To celebrate, we held a client’s party in Bellevue, WA, and it was a blast! Oleg’s clients came from all over the continent to share in his success and congratulate him on his incredible career. It was truly a celebration of excellence in the real estate market!

From Oleg:

“Dear friends, May this Christmas bring you great joy, fulfillment of all your dreams, peace, and happiness! First and foremost, I’m beginning with a heartfelt, and well-deserved THANK YOU! Thank you for coming last Saturday, and making this event possible! This event would not happen without your presence, friendship, and dedication. I know you are busy with life, family, kids, and many other events in this special holiday season, but you made time to celebrate this Christmas with me! I’m proud and happy to have such amazing clients, business partners, and friends! Special thank you for your help and support in organizing this event to: Inna Tan- my beautiful wife, who supports me in everything I do and for dedication to this Christmas Party!”

Western Washington Real Estate Market Update

The following analysis of the Western Washington real estate market is provided by Windermere Real Estate Chief Economist, Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere agent.

A MESSAGE FROM MATTHEW GARDNER

Needless to say, any discussion about the U.S. economy, state economy, or housing markets in the first quarter of this year is almost meaningless given events surrounding the COVID-19 virus.

Although you will see below data regarding housing activity in the region, many markets came close to halting transactions in March and many remain in some level of paralysis. As such, drawing conclusions from the data is almost a futile effort. I would say, though, it is my belief that the national and state housing markets were in good shape before the virus hit and will be in good shape again, once we come out on the other side. In a similar fashion, I anticipate the national and regional economies will start to thaw, and that many of the jobs lost will return with relative speed. Of course, all of these statements are wholly dependent on the country seeing a peak in new infections in the relatively near future. I stand by my contention that the housing market will survive the current economic crisis and it is likely we will resume a more normalized pattern of home sales in the second half of the year.

HOME SALES

- There were 13,378 home sales during the first quarter of 2020, a drop of only 0.2% from the same period in 2019, but 27% lower than in the final quarter of 2019.

- The number of homes for sale was 32% lower than a year ago and was also 32% lower than in the fourth quarter of 2019.

- When compared to the first quarter of 2019 sales rose in eight counties and dropped in seven. The greatest growth was in Cowlitz and Lewis counties. The largest declines were in Island and Snohomish counties.

- Pending sales — a good gauge of future closings — rose 0.7% compared to the final quarter of 2019. We can be assured that closed sales in the second quarter of this year will be lower due to COVID-19.

HOME PRICES

- Home-price growth in Western Washington rose compared to a year ago, with average prices up 8.7%. The average sale price in Western Washington was $524,392, and prices were 0.4% higher than in the fourth quarter of 2019.

- Home prices were higher in every county except San Juan, which is prone to significant swings in average sale prices because of its size.

- When compared to the same period a year ago, price growth was strongest in Clallam County, where home prices were up 21.7%. Double-digit price increases were also seen in Kitsap, Skagit, Mason, Thurston, and Snohomish counties.

- Affordability issues remain and, even given the current uncertain environment, I believe it is highly unlikely we will see any form of downward price pressures once the region reopens.

DAYS ON MARKET

- The average number of days it took to sell a home in the first quarter of this year dropped seven days compared to the first quarter of 2019.

- Pierce County was the tightest market in Western Washington, with homes taking an average of only 29 days to sell. All but two counties — San Juan and Clallam — saw the length of time it took to sell a home drop compared to the same period a year ago.

- Across the entire region, it took an average of 54 days to sell a home in the first quarter of the year — up 8 days compared to the fourth quarter of 2019.

- Market time remains below the long-term average across the region. This is likely to change, albeit temporarily, in the second quarter due to COVID-19.

CONCLUSIONS

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

Given the current economic environment, I have decided to freeze the needle in place until we see a restart in the economy. Once we have resumed “normal” economic activity, there will be a period of adjustment with regard to housing. Therefore, it is appropriate to wait until later in the year to offer my opinions about any quantitative impact the pandemic will have on the housing market.

ABOUT MATTHEW GARDNER

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

Original post appeared at www.windermere.com.

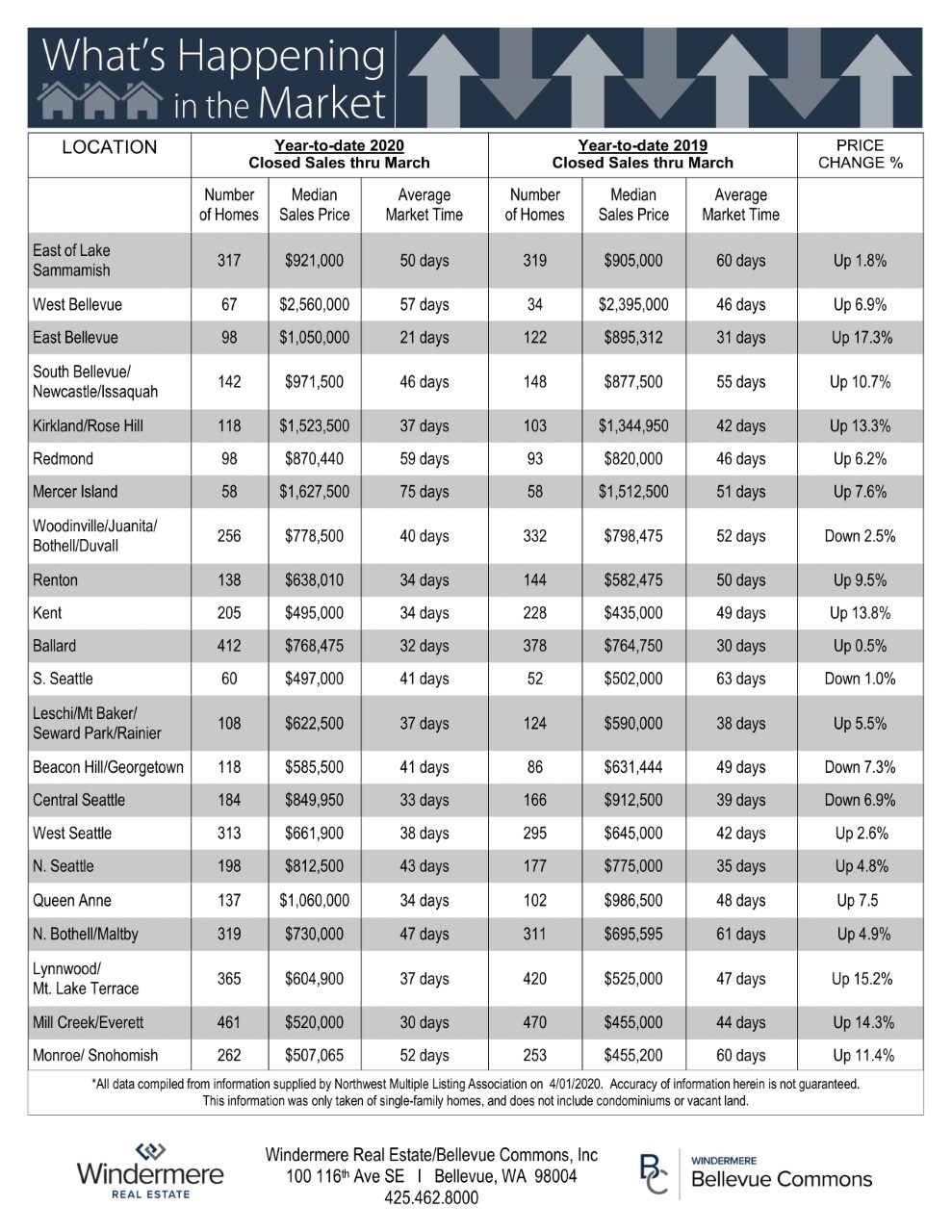

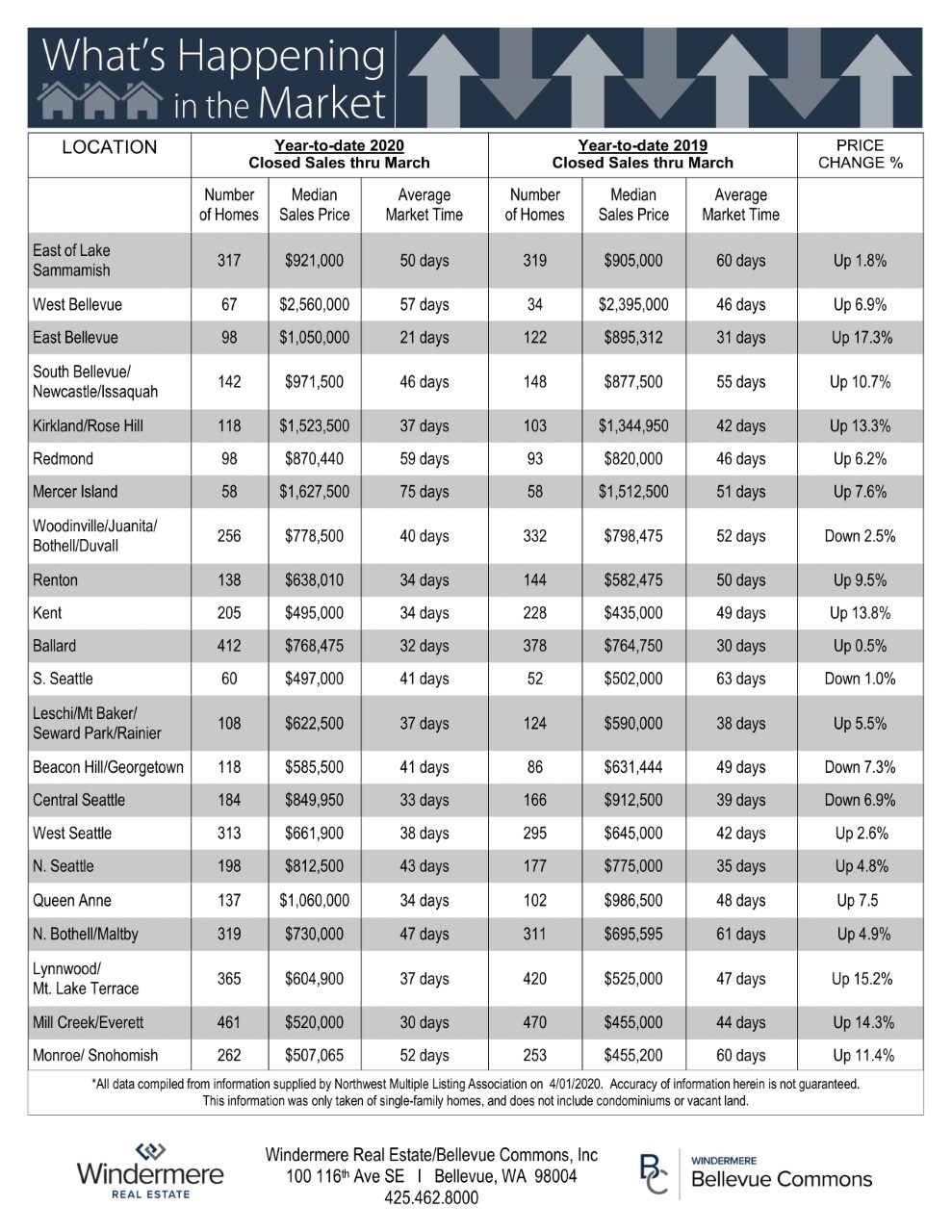

Local Market Update April 2020

Windermere is focused on keeping our clients and our community safe and connected. We’re all in this together. Since the early days of COVID-19, our philosophy has been “Go slow and do no harm.” While real estate has been deemed an “essential” business, we have adopted guidelines that prioritize everyone’s safety and wellness.

Like everything else in our world, real estate is not business as usual. While market statistics certainly aren’t our focus at this time, we’ve opted to include our usual monthly report for those who may be interested. A few key points:

- The monthly statistics are based on closed sales. Since closing generally takes 30 days, the statistics for March are mostly reflective of contracts signed in February, a time period largely untouched by COVID-19. The market is different today.

- We expect that inventory and sales will decline in April and May as a result of the governor’s Stay Home order.

- Despite the effects of COVID-19, the market in March was hot through mid-month. It remains to be seen if that indicates the strong market will return once the Stay Home order is lifted, or if economic changes will soften demand.

Every Monday Windermere Chief Economist Matthew Gardner provides an update regarding the impact of COVID-19 on the US economy and housing market. You can get Matthew’s latest update here.

Stay healthy and be safe. We’ll get through this together.

EASTSIDE

KING COUNTY

SEATTLE

SNOHOMISH COUNTY

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GetTheWReport.com

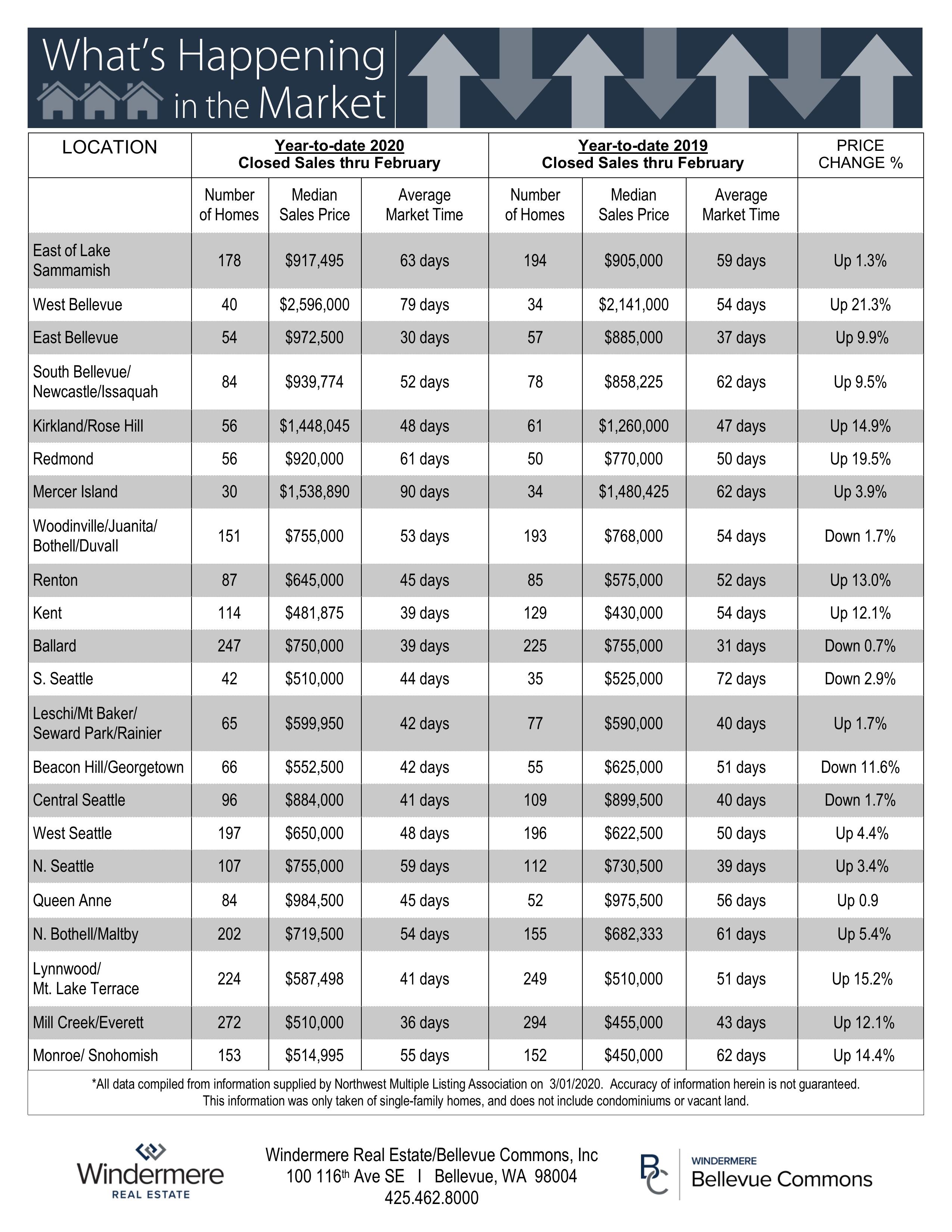

March 2020 “What’s happening in the Market”

Even during these times of uncertainty, one thing is for sure. People need housing and available housing is very limited right now. The core principle of Supply and Demand are at work as we see a decline in listed properties during the Stay Home, Stay Healthy order, and Multiple offers are still the trend. Prices for the month of March have risen slightly in most area’s while Days on Market continue to fall below last years timeframes. Nothing has changed that well positioned homes (Price & Condition) are highly sought after & gets the highest price!!

What does it mean to be “All in” during COVID?

At Windermere, being “all in” means our agents love what they do, acting beyond themselves, and being there when it counts. During these uncertain times, I want you to know that I am more focused than ever on taking care of my clients and helping them move their dreams forward. As a Real Estate agent, I am honored to support my clients who have purchased and sold their home during Covid19 stay-in-place orders. My first thought is the safety and well being of everyone engaged in the process.

We focus on the positive; we have tools, techniques and an amazing, creative team that has allowed us to move forward with our clients. We are proud to say we have completed every deal, on time.

If you need to sell or purchase a home or know someone, we can help get the job done. We can do this for you today. We especially appreciate your referrals at this challenging time. Please know, we are doing this with safety and health as our first and highest priority.

Supporting Local Businesses during the Covid-19 Outbreak

Many small businesses have been impacted by COVID-19 due to mandated closures and customers staying at home. We can help them by doing things like:

- Order take-out from restaurants that offer it, and pick up directly if possible rather than 3 rd-party delivery to avoid fees charged back to the restaurant.

- Buy gift cards from service providers like hair salons (gift them or use them later).

- Buy locally whenever possible, and look for online stores from local providers.

- If you can afford to continue paying service providers who can’t work but depend on your income, do.

- Check into online services and classes offered by local fitness studios, tutors, financial planners and more.

- Tip delivery people generously if you can. They’re on the front lines of exposure. (And of course if you feel sick, avoid direct contact with them.)

First posted at windermere-bellevue.com

How will the Coronavirus impact the Housing Market? Update March 16, 2020

Windermere Chief Economist Matthew Gardner has been following the situation closely, watch this video for his thoughts on how COVID-19 will impact the national housing market and economy.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link